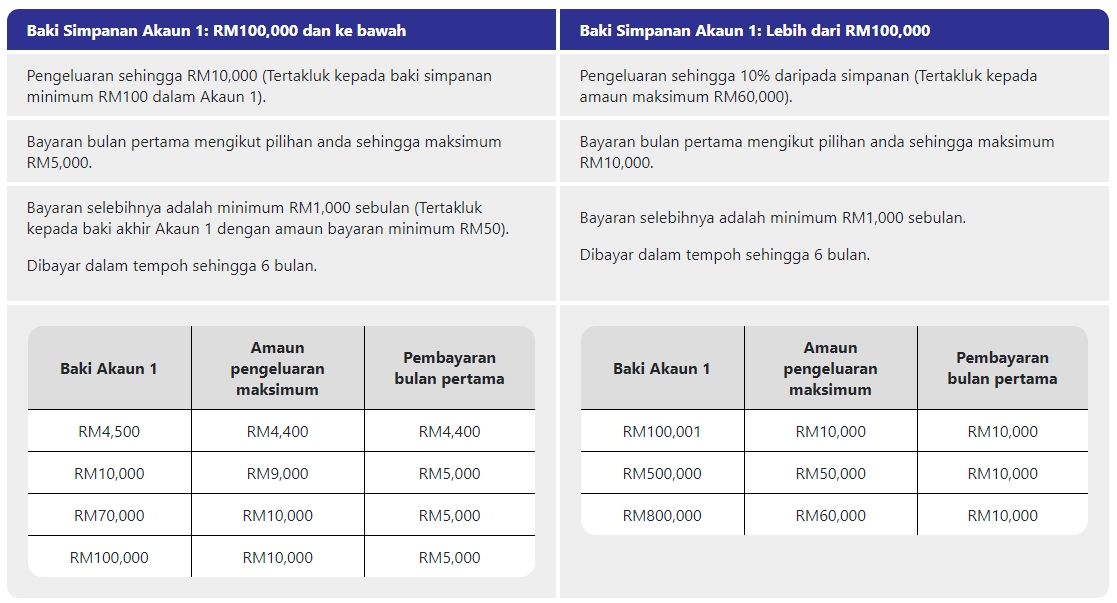

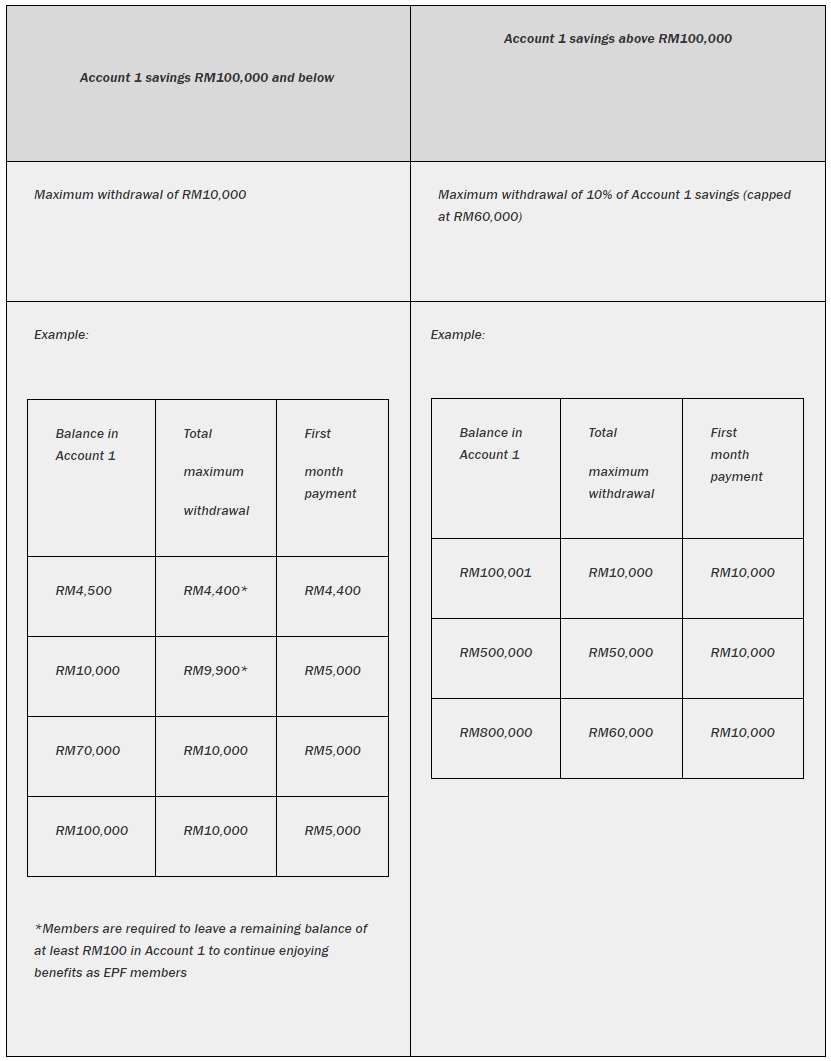

Category 1 members have been able to submit their applications since Dec 1 2020 while members under Category 2 can start applying today. The eligible amount for i-Sinar is subject to the members Account 1 balance based on the latest details below.

Updated I Sinar Program Details Epf Members Can Start To Apply I Sinar Starting From 21 Dec 2020 News Puchong Co

This was done via the i-Lestari i-Sinar and i-Citra schemes which resulted in a total withdrawal of RM 101 billion by 74 million members.

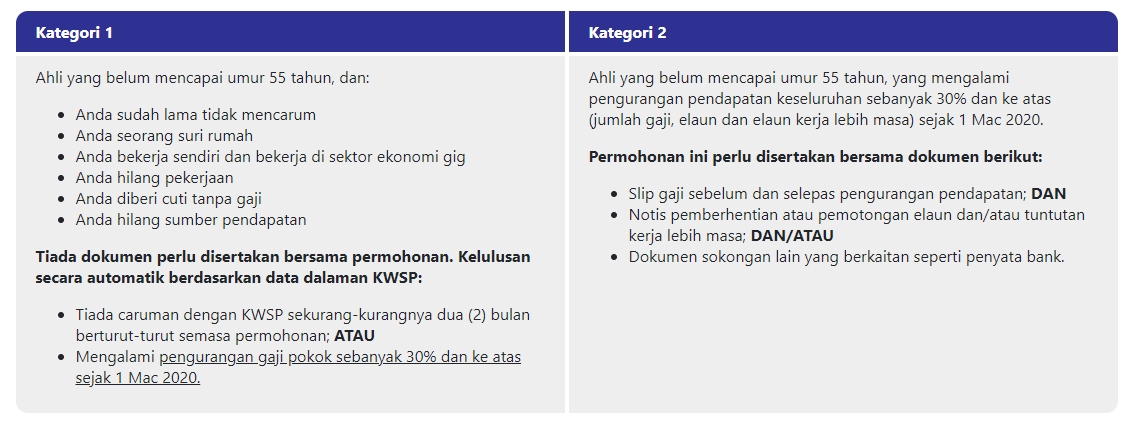

. The Employees Provident Fund EPF is in the process of lifting several conditions for the i-Sinar withdrawal facility which among others will allow contributors under the age of 55 to withdraw from their Account 1 funds. EPF mmembers can mafe the withdrawal at httpspengeluarankhaskwspgovmy through the i-Account starting 1 April. The process of verification is required to avoid fraud and improper withdrawal of i-Sinar funds by third parties.

For those who have. I lost my job. The government has announced an extension of its i-Sinar programme to allow all Malaysians to withdraw funds from Account 1 of the Employees Provident Fund EPF.

I have not contributed to the EPF for at least two 2 consecutive months. The move will benefit some eight million EPF contributors Finance Minister Tengku Zafrul Aziz said in the Dewan Rakyat today. It is an extension of the previous i-Lestari Account 2 withdrawal programme that ends in March 2021.

Applications start from 21 Dec 2020. For further information members may contact the i-Sinar hotline at 03-8922 4848. I am given unpaid leave.

With the announcement i-Sinar will benefit 2 million eligible members and result in a total. If you go to the i-Sinar portal. Payments will be staggered over a maximum period of six 6 months with the first payment of up to RM5000.

For members who fulfil the criteria their application will be approved automaticallyOnly confirmation of the maximum amount is required during members online application and is not difficult. Your current EPF and income status. For those with they can withdraw any amount up to RM10000.

Despite the convenience offered the facility is not a withdrawal or a form of free cash because EPF. They have to withdraw from the savings balance in their Account 2 before accessing the savings in Account 1. Heres a quick step-by-step application guide.

I am self-employed and working in the economic sector. It said only confirmation of the maximum amount is required during members online application which is not difficult. As before the withdrawal amount allowed for i-Sinar is still subject to the members Akaun 1 balance but the criteria have been updated to the following.

KUALA LUMPUR March 9 Employees Provident Fund EPF has updated its i-Sinar program which now allow members to amend or cancel their application. Through the facility which expects to benefit half of its 14 million contributors members can withdraw up to RM60000 from their account one. However the maximum total amount withdrawal allowed is RM60000.

I have lost my source of income. The payments will be staggered over a period of six 6 months with the first payment of up to RM10000. Through the Employees Provident Funds EPF i-Sinar facility members can withdraw up to RM60000 from their Account 1.

So far EPFs investments and returns have not been affected to the point that would cause i-Lestari and i-Sinar withdrawals to have been a serious policy misstep in hindsight. The process of verification is required to avoid fraud and improper withdrawal of i-Sinar funds by third parties. Check your eligibility here.

This initiative was launched by the EPF for the purpose of easing the financial burden of members whove been affected by the Covid-19. However the amount withdrawn will be subject to the account balance. 1 According to EPF this has resulted in 61 million members having less than RM 10000 currently in their savings and a staggering 79 of them having less than RM 1000 left consequently.

For members who fulfill the criteria their application will be approved automatically the EPF said. I am a housewife. In general the withdrawal will add liquidity to the countrys economy and this should give a boost to economic activities as Malaysians have a high tendency to spend Yesterday the EPF said it expects the i-Sinar facility to benefit two million eligible members with an estimated advance amount of RM14 billion to be made available.

According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old. EPF members are allowed to withdraw a maximum amount of RM10000 and a minimum of RM50. The EPF i-Sinar initiative enables EPF members to make a partial withdrawal from their savings in EPF Account 1.

Contributors with RM100000 and below in their Akaun 1 are allowed to withdraw up to RM10000 with payments to be disbursed over a maximum period of six months. However allowing for the unconditional withdrawal of Account 1 under i-Sinar and now under i-Citra could set an undesirable precedent ie unintended consequences for the future. If youve applied for i-Sinar withdrawal but didnt maximise the full withdrawal limit or have made a mistake heres your chance to update your application.

I Sinar 8 Other Things You Can Use Your Epf For

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Takaful Household Plan Protection Plans How To Plan Protection

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Why I Sinar Went Wrong And Why Epf Contributors Shouldn T Be Treated Like White Knights Consumers Association Penang

Bernama Epf Offers Further Details On I Sinar In Response To Media Query

I Sinar 8 Other Things You Can Use Your Epf For

Image The Star Survival Animal Spirit Cards Retirement Fund

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

Epf Approves Rm19 62 Billion Worth I Sinar Applications Businesstoday

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

How To Apply For Epf I Sinar And What You Must Know Mypf My

What Is Epf I Sinar Donovan Ho

I Sinar 8 Other Things You Can Use Your Epf For

Need To Withdraw More Funds Epf I Sinar Applications Can Now Be Amended Online